Building a Data Foundation for Agentic AI: Best Practices for Fintech

Okay, so we all know data is the lifeblood of AI. But when it comes to Agentic AI in Fintech, we’re talking about a whole different level of data dependency. These AI systems aren’t just crunching numbers; they’re making autonomous decisions that can have a real impact on people’s lives. So, how do we build a data foundation that’s up to the task? Let’s dive in and explore the best practices for creating a robust and reliable data infrastructure for Agentic AI in the financial sector.

The Agentic AI Data Challenge: Beyond Traditional Data Pipelines

Think of it this way: if you’re going to let an AI make decisions on its own, you better make sure it’s working with the best possible information. That means more than just having a lot of data; it’s about good data management, quality, real-time access, and rock-solid governance. In developing Agentic AI, we need to move beyond traditional data pipelines and embrace a more dynamic, responsive, and secure data ecosystem.

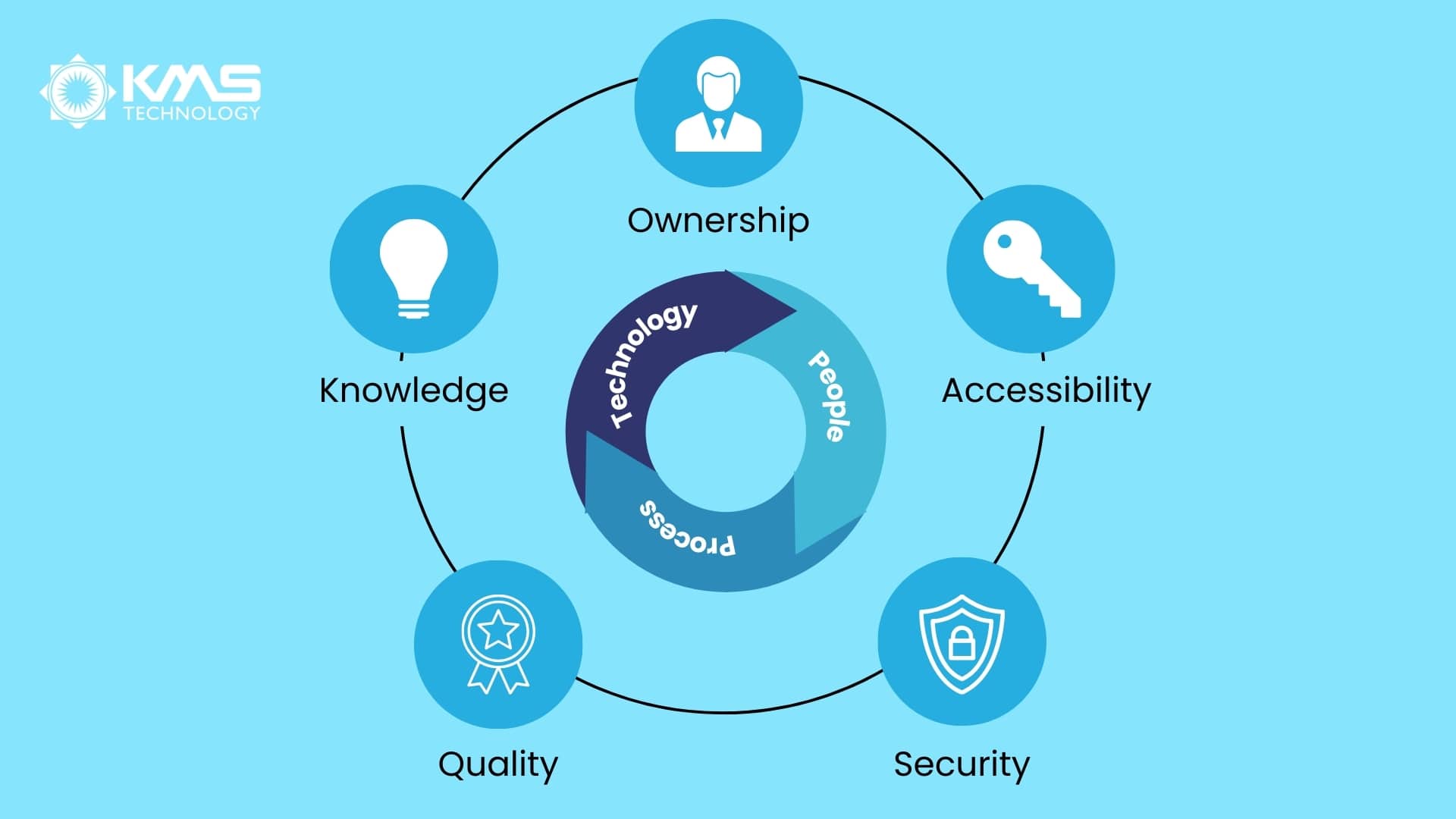

Data Governance: The Cornerstone of Agentic AI Success

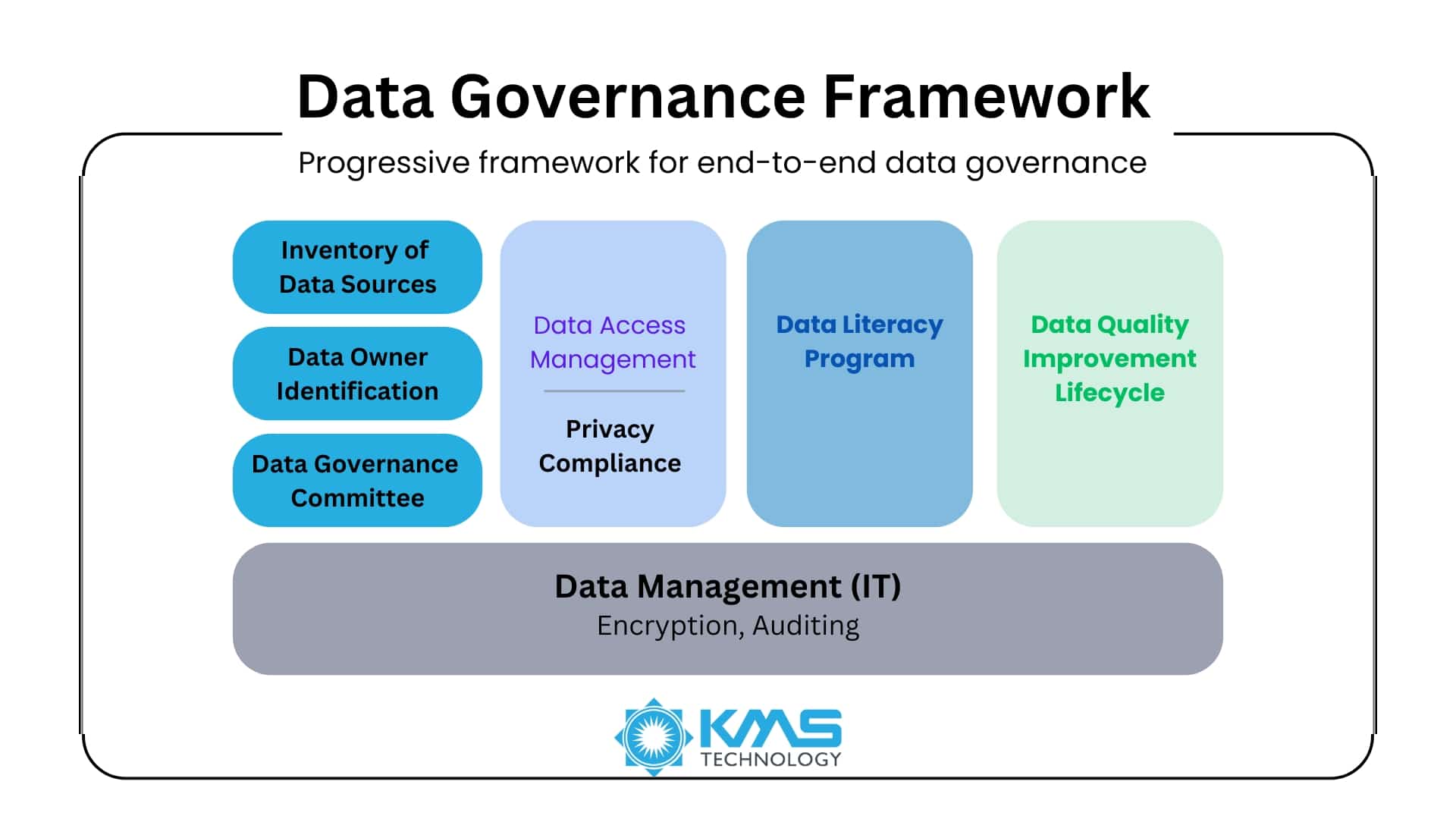

In the world of Agentic AI, where systems make autonomous decisions, data governance is not just a best practice; it’s a necessity. Imagine an AI making critical investment decisions based on inaccurate or incomplete data. The consequences could be disastrous. That’s why robust data quality checks, comprehensive security measures, and strict adherence to privacy regulations are essential for good data governance.

For instance, in autonomous fraud detection, data lineage is crucial. We need to trace the origin of every data point to ensure its reliability and identify any potential tampering. Similarly, in personalized financial planning, we must implement strong access controls to protect sensitive customer data and ensure compliance with privacy regulations like GDPR and CCPA.

Implementing a robust data governance framework involves defining clear roles and responsibilities, establishing data policies and procedures, and using tools and technologies to automate data quality checks and security measures. By prioritizing data governance, Fintech companies can build trustworthy and reliable Agentic AI systems.

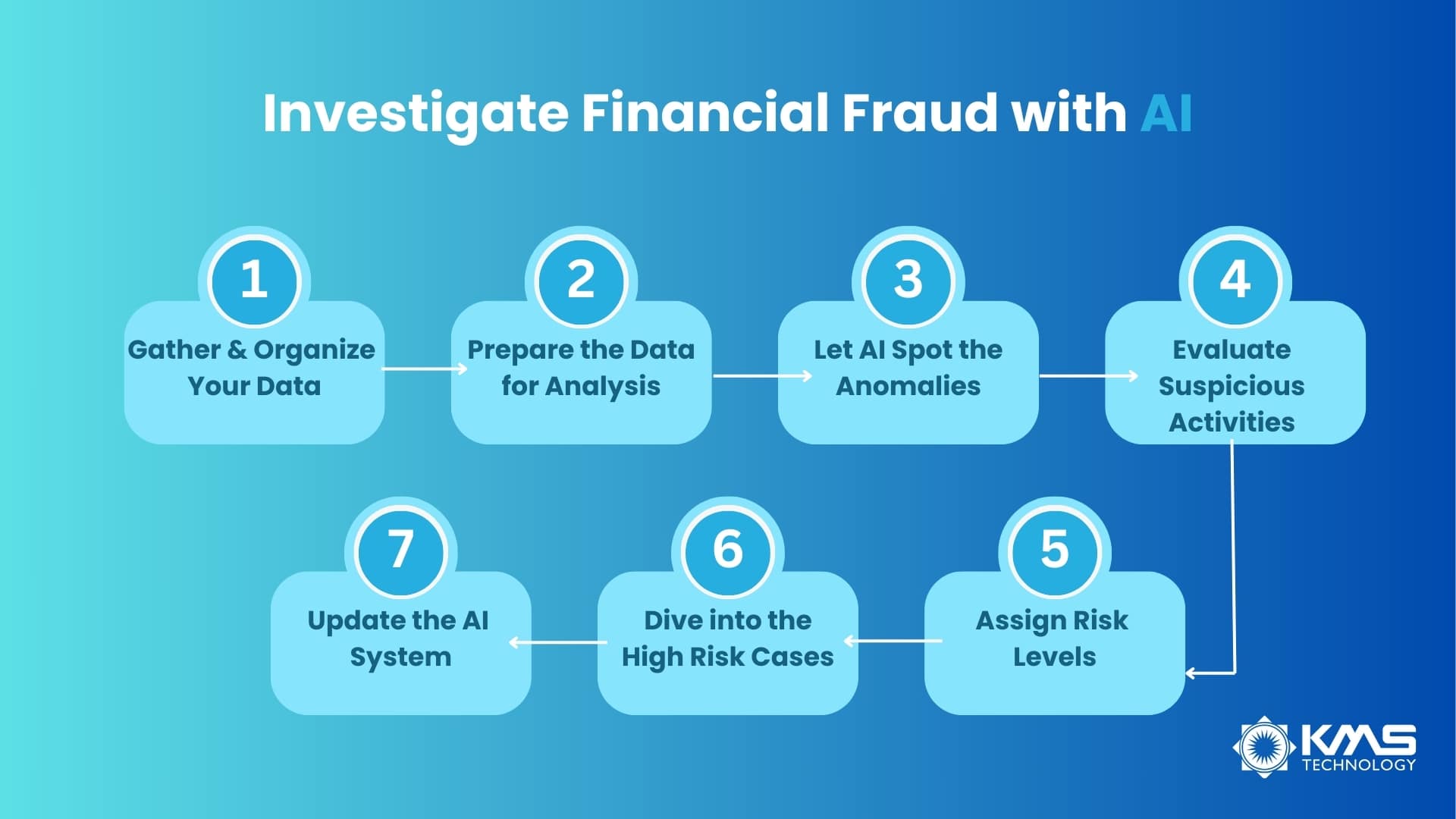

1. Autonomous Fraud Detection: Catching the Malicious Actors in Real Time

Imagine an AI that can spot fraudulent transactions before they even happen. That’s the power of Agentic AI, but it relies heavily on a strong data governance framework. To make it work, you need a data foundation that can:

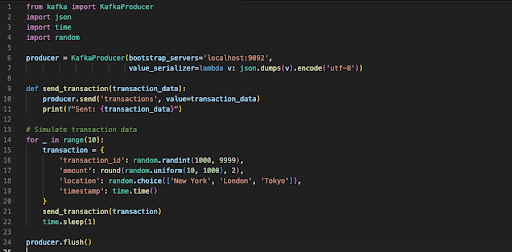

- Stream Data Continuously: Fraudsters don’t wait, and neither can your AI. We need real-time data streams from transaction systems, customer activity logs, and external sources. This involves integrating various data sources, including APIs, message queues, and streaming platforms, to ensure a continuous flow of information. Data lineage is critical here, ensuring that every data point used for real-time analysis is traceable and reliable.

Code Snippet: Kafka Producer Example (Python) – shows how real-time transaction data can be sent to a Kafka topic for processing.

- Adapt and Learn: Fraud patterns change, so your AI needs to learn and adapt. That means using anomaly detection algorithms and training models on evolving data sets. Techniques like online learning and reinforcement learning can be employed to enable continuous model updates. To ensure models are trained on high-quality, unbiased data, preventing the AI from learning and perpetuating fraudulent patterns, proper data governance is needed.

- Explain Its Reasoning: If the AI flags a transaction as fraudulent, we need to know why. That’s where data provenance and explainable AI come in. Implementing data lineage tracking and XAI methods like SHAP or LIME allows for transparency and accountability. Well-structured processes ensure the AI’s decision-making is transparent and auditable, supporting explainability.

Real-World Example:

A customer makes an unusual purchase in a foreign country. The AI analyzes transaction history, location data, and real-time fraud alerts to determine if the transaction is legitimate. If it flags it, it can notify the customer immediately and prevent potential losses. This requires a data foundation that can handle high-velocity data streams and perform real-time analysis.

2. Personalized Financial Planning: Knowing Your Customers Inside and Out

Agentic AI can provide truly personalized financial planning, but it needs a 360-degree view of the customer, all while adhering to strong data governance principles. That means:

- Integrating Diverse Data Sources: Bank accounts, investment portfolios, spending habits, even social media data—it all plays a role. This requires a data integration strategy that can handle structured and unstructured data from various sources. These diverse sources must be integrated in a secure and compliant manner, protecting user privacy.

- Understanding Context: The AI needs to understand the customer’s financial goals, risk tolerance, and life events. This involves building a knowledge graph that captures the relationships between different data points. Effective data management ensures that the AI’s contextual understanding is derived from accurate and reliable real-time data, preventing misinterpretations.

- Protecting Privacy: We’re dealing with sensitive financial data, so data privacy and security are paramount. Implementing techniques like differential privacy and federated learning can help protect sensitive data and user privacy to ensure data governance best practice.

Real-World Example:

An AI analyzes a customer’s spending habits and investment portfolio to identify opportunities for saving and growth. It can even provide personalized recommendations for budgeting and retirement planning. This requires a data foundation that can handle complex data relationships and perform contextual analysis.

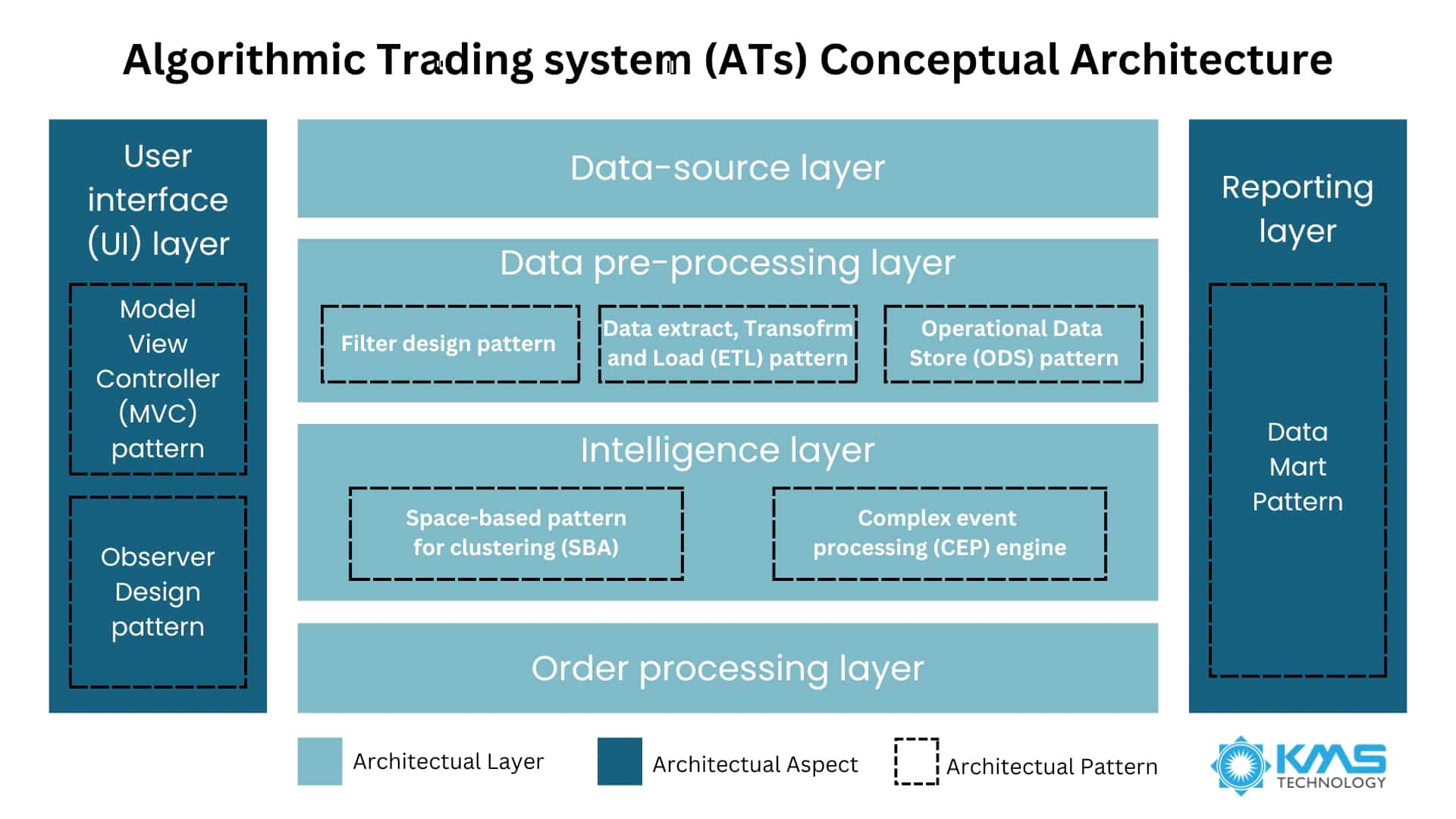

3. Algorithmic Trading Strategies: Reacting to the Market in Milliseconds

In the fast-paced world of algorithmic trading, Agentic AI needs to react to market events in real time, and this requires strict adherence to data governance best practices. That means:

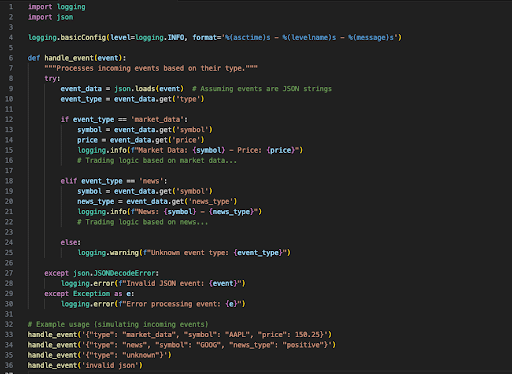

- Event-Driven Architectures: Systems that can process and react to market events as they happen. This involves building an event-driven architecture that can handle high-frequency data streams. Event data must be processed and stored securely, maintaining data integrity.

Code Snippet: Basic Event Processing in an Event-Driven Architecture (Python)

- High-Velocity Market Data Streams: Real-time access to market data from exchanges and financial news sources. This requires integrating with market data providers and implementing efficient data ingestion pipelines. Thorough validation and verification ensure these streams are accurate and reliable, preventing the AI from making decisions based on faulty information.

- Data Lineage and Model Versioning: Keeping track of data sources and model versions for regulatory compliance and risk management. This involves implementing a data governance framework that captures data provenance and model lineage.

Real-World Example:

An AI trading system analyzes real-time market data and news feeds to identify arbitrage opportunities. It can execute trades in milliseconds, taking advantage of fleeting market inefficiencies. This requires a data foundation to handle high-velocity data streams and perform real-time analysis.

Best Practices for Building a Data Foundation

- Data Quality and Governance: Implement robust data quality checks and data governance policies to ensure data accuracy and reliability.

- Real-Time Data Processing: Build data pipelines that can handle real-time data streams and perform low-latency analysis.

- Scalability and Flexibility: Design data infrastructure that can scale to handle increasing data volumes and adapt to changing business needs.

- Security and Privacy: Implement strong security measures and privacy-preserving techniques to protect sensitive financial data.

- Explainability and Transparency: Build data systems that support explainable AI and data lineage tracking.

Building the Future of Fintech with Robust Data Foundations

The journey into Agentic AI within the fintech landscape is undeniably exciting, promising a future of autonomous decision-making, hyper-personalization, and lightning-fast responses to market dynamics. However, as we’ve explored, the true engine powering this revolution isn’t just the algorithms themselves, but the robust and well-managed data infrastructure that underpins them. The examples of autonomous fraud detection, personalized financial planning, and algorithmic trading strategies all underscore a fundamental truth: the efficacy and reliability of Agentic AI in finance are inextricably linked to the quality, accessibility, and governance of the data it consumes.

Moving beyond traditional data pipelines is paramount. We need agile and responsive systems capable of handling the velocity and variety of financial data. This necessitates a strong emphasis on data governance to ensure accuracy, security, and compliance across all data touchpoints. Without a solid framework for managing data lineage, quality checks, and access controls, the potential for errors, biases, and security breaches increases significantly, undermining the very trust we aim to build with these advanced AI systems.

Furthermore, the ability to leverage real-time data is no longer a luxury but a necessity in the fast-paced world of finance. Whether it’s identifying fraudulent transactions as they occur, providing timely personalized advice, or executing trades in milliseconds, the speed at which data can be processed and acted upon is critical. This demands sophisticated data processing capabilities that can handle high-velocity streams and deliver insights with minimal latency.

Ultimately, the successful deployment of Agentic AI in Fintech hinges on a holistic approach to data. It requires a commitment to building data foundations that are not only technologically advanced but also ethically sound and legally compliant. By prioritizing data governance, investing in efficient data processing pipelines, and ensuring seamless access to real-time data, financial institutions can unlock the transformative potential of Agentic AI and usher in a new era of innovation and customer value. The future of fintech is intelligent and autonomous, and it is built on a foundation of exceptional data management.

Key Takeaways: Powering Agentic AI in Fintech

Here are the key takeaways to remember when building a data foundation for Agentic AI in Fintech:

- Strong Data Governance is Non-Negotiable: Implement robust data governance frameworks encompassing data quality checks, security protocols, and compliance measures to ensure the reliability and trustworthiness of your Agentic AI systems.

- Embrace Real-Time Data Processing: Build data pipelines capable of handling and analyzing real-time data streams to enable timely decision-making in applications like fraud detection and algorithmic trading.

- Data Processing Must Be Efficient and Scalable: Invest in advanced data processing technologies and architectures that can handle the increasing volume and velocity of financial data while maintaining low latency.

- Real-Time Data Fuels Personalization: Leverage real-time data to gain a 360-degree view of customers, enabling highly personalized financial planning and recommendations.

- Data Governance Ensures Compliance in Algorithmic Trading: Strict adherence to data governance principles, including data lineage and model versioning, is crucial for regulatory compliance and risk management in algorithmic trading strategies that rely on real-time data.

- Continuous Data Processing Enables Adaptive AI: Implement continuous data processing and model training techniques to ensure your Agentic AI systems can adapt to evolving fraud patterns and market dynamics.

- Transparency Requires Data Governance: Well-defined data governance processes support explainable AI by ensuring the transparency and auditability of the AI’s decision-making processes, especially when dealing with sensitive financial data.

The Bottom Line

Building a data foundation for Agentic AI in Fintech is no small feat. It requires a focus on data quality, real-time access, and robust governance. But the rewards are immense: AI systems that can make smarter decisions, provide better customer experiences, and help us navigate the complex world of finance. By implementing these best practices, we can unlock the full potential of Agentic AI and drive innovation in the financial sector.

Frequently Asked Questions (FAQs)

- Why is real-time data so important for Agentic AI in Fintech?

- Agentic AI often needs to react to dynamic market conditions or detect fraud anomalies in real time. This requires real-time data streams and low-latency processing.

- How can Fintech companies ensure data quality for Agentic AI?

- Implementing robust data validation, cleansing, and transformation pipelines is essential. Data governance frameworks and data quality audits are also crucial.

- What are the key considerations for building a scalable data infrastructure?

- Scalability requires designing systems that can handle increasing data volumes and adapt to changing business needs. This involves using cloud data platforms, distributed computing, and efficient data storage.

- How can Fintech companies protect sensitive data in Agentic AI systems?

- Implementing strong data encryption, access control, and data anonymization techniques is crucial. Differential privacy and federated learning can also be employed.

- What role does data governance play in Agentic AI?

- Data governance ensures data quality, data security, and regulatory compliance. It establishes policies for data management, data access, and data auditing.

- How does a company begin to build a proper data foundation for Agentic AI?

- Begin with a data audit, then implement a data governance plan. Build data pipelines and focus on real-time data collection.

Additional Resources

- Cloud Data Platforms (AWS, Azure, GCP):

- Data Streaming Platforms (Kafka, Flink):

- Apache Kafka: https://kafka.apache.org/

- Apache Flink: https://flink.apache.org/

- Data Governance Frameworks (DAMA-DMBOK):

- DAMA International: https://dama.org/ (DMBOK is available through DAMA)

- Data Security Standards (ISO 27001):

- Data Privacy Regulations (GDPR, CCPA):

- GDPR: https://gdpr-info.eu/