The Top 6 Private Equity Trends for 2025

The year ahead will challenge private equity firms to evaluate and redefine their strategies. Tech leaders, investors, and entrepreneurs alike are grappling with questions like:

- Will AI revolutionize industries, or is the hype about to fizzle?

- How will shifting economic conditions and new legislation reshape opportunities in tech?

- How can firms harness digital transformation to stay competitive—or survive?

While the future remains uncertain, one thing is clear: with the right approach, firms can edge ahead of competitors or become more resilient to growing risks.

Here are the top six private equity trends influencing 2025—and what they mean for your strategy.

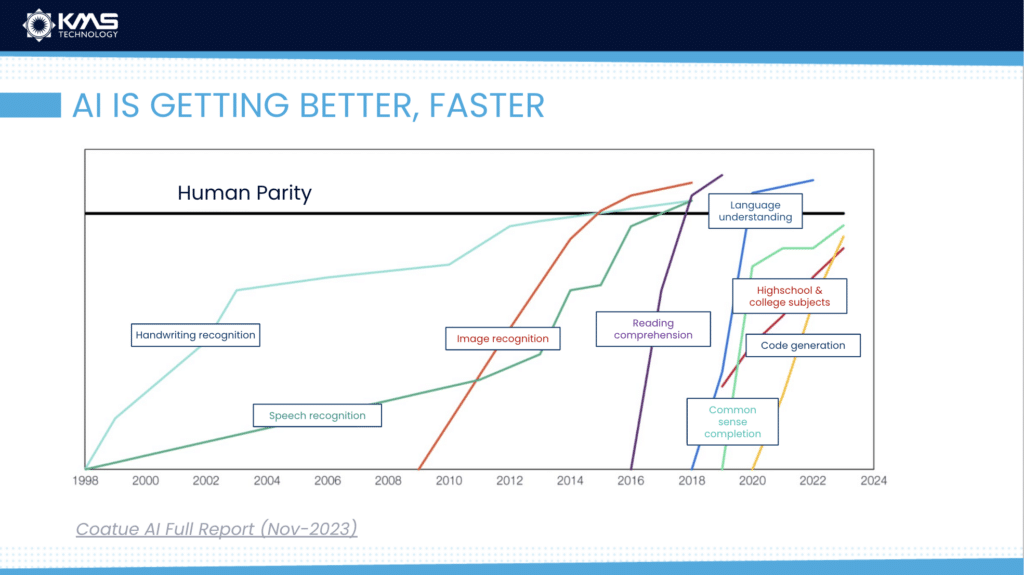

1. Artificial Intelligence Leads Technology Investments

While global venture funding is slowing down, the technology sector is an exception to the rule with artificial intelligence (AI) leading the charge.

PE and VC firms are doubling down on sectors like AI, cybersecurity, fintech, and healthcare technology.

In Q3 2024, funding for AI startups reached a staggering $18.9 billion, accounting for 28% of all venture capital investment—surpassing healthcare and biotech ($15 billion) and hardware ($13 billion)1. This surge underscores AI’s dominance as an investment opportunity, with substantial funding directed at proven companies in large, late-stage rounds.

Investors are also increasingly drawn to AI infrastructure to meet the growing demand for advanced AI computing. Generative AI, particularly in content creation and healthcare, remains a hotbed of activity despite concerns about scalability and costs.

Meanwhile, industry-specific applications in fields like finance, healthcare, and defense are gaining traction, reflecting a maturing ecosystem focused on solving niche challenges. While seed-stage deals have slowed, venture capital is shifting toward profitability and sustainable business models, signaling a more disciplined approach to growth in the evolving tech landscape.

2. Cybersecurity & Testing Are Paramount

Cybersecurity continues to take center stage as businesses rush to adopt advanced protection measures amidst escalating cyber threats. Firms that can provide integrated security solutions—combining protection, detection, and incident response—will attract significant PE interest.

Private equity investments in cybersecurity reached $8.5 billion by mid-2024, highlighting its role as a resilient and high-growth sector.2 Significant efforts are underway globally to enhance cybersecurity regulation and compliance protocols. From the upcoming UK Cyber Security and Resilience Bill to similar efforts in the US and EU, PE investors must evaluate the compliance-readiness of their targets. Firms incorporating ‘compliance-by-design’ practices can stay ahead and seize related opportunities within the regulatory technology sector.

Additionally, public IT failures like the CrowdStrike outage, which grounded countless flights globally in 2024, have drawn more attention to the need for robust testing in software development. While agility is critical, speed to market cannot come at the expense of software quality or security loopholes.

As the rate of innovation increases, so do the demands for cybersecurity and testing frameworks, which is reflected in the dollars being funneled to these sectors.

3. Changing Economic Conditions Demand Resiliency

Geopolitical uncertainties, including potential tariffs, are likely to impact PE investments in specific sectors. US-based manufacturing and logistics remain well-positioned as resilient targets, commanding investor premiums. However, international operations with exposure to regulatory risks or trade conflicts may face headwinds.

As such, many PE thought leaders expect to see an increase in exits for at-risk companies.3 That said, decisions cannot be made without the specifics of legislation. Thus, diligence processes can become more robust to account for potential impacts, including the downstream effects of supply chain disruptions.

Following the increasing demand for Generative AI, semiconductors are uniquely positioned as an investment opportunity in the wake of the CHIPS Act. $450 billion in private investments have already been made in semiconductors, which will likely increase.4 As stated before, AI infrastructure is a key investment driver.

What does that mean for Private Equity? New regulatory frameworks, such as the EU’s AI Act, require deeper due diligence to ensure that portfolio companies remain compliant. For example, companies using AI must meet strict rules surrounding data security and ethical use, which add complexity to tech-focused investments and a greater need for expertise.

4. Digital Transformation is Coming for Private Equity

The same pressures that promote greater investments in AI and Cybersecurity are impacting PE firms themselves. The impetus to adapt to emerging technologies is enormous, given that it’s easier now than ever to fall behind.

PE firms are leveraging digital transformation to maximize efficiency and make better investment decisions. Many are using AI and machine learning tools internally to streamline investment processes, provide predictive analytics, and uncover untapped market opportunities.

For example, Blackstone’s proprietary investment tools leverage AI to enable comprehensive deal analysis, helping manage data-intensive decisions across their global footprint. By deploying in-house AI tools to improve due diligence, Blackstone enables deep sector and company analysis far faster than traditional methods. This approach can provide a competitive edge in finding high-value assets within crowded markets.5 Tools like these are becoming the norm within leading firms striving to maintain a competitive advantage.

Beyond internal processes, private equity firms are also guiding portfolio companies through their digital transformation journeys. This includes enhancing customer success programs, improving operational efficiencies, and modernizing IT infrastructure with cloud-based solutions. Cutting costs with cloud transformation will be more critical in 2025, because data storage and management is tied just as closely to AI as the infrastructure that enables it.

5. Tech Due Diligence is More Critical Than Before

Rapid technology innovation and an increase in cashflow create incredible opportunities for investors—but the pace of change, paired with largely untested technology, leads to a multitude of risks. PE firms are not always well-positioned to assess the minutia of every potential investment.

Thus, investors should consider:

- Scalability Potential: Evaluate whether the company’s infrastructure can support growth aligned with the investment thesis.

- Technology Readiness: Assess the age and functionality of a company’s product stack, with an eye towards innovation and modernization.

- Revenue Resilience: Analyze recurring revenue streams such as SaaS subscriptions, which offer greater reliability during economic downturns.

- Operational Defensibility: Determine how proprietary intellectual property or unique processes protect a company from competition or market disruption.

These factors are critical for effective technology due diligence, and abiding by them will help investors minimize risk.

6. Dynamics are Shifting in M&A

The rising cost of capital and increasing scrutiny over valuations will pressure PE firms to be more strategic in their mergers and acquisitions. Co-investment opportunities and partnerships between PE firms and corporations may become more common.

At the same time, competition will intensify as institutional investors and sovereign wealth funds increase their presence in tech-focused deals, making differentiation and niche expertise key competitive advantages.

As such, PE firms will need to consider the gaps in their technology stable. In terms of portfolio health, firms may double down in areas that they know well, leveraging portfolio companies in M&A deals to steadily build the firm’s footprint and diversify their investments. Firms who build within a niche may be able to more effectively provide resources and expertise to portfolio companies, allowing investments to grow sustainably.

The private equity landscape is on the brink of transformation, driven by rapid technological advancements, shifting economic dynamics, and a wave of regulatory changes. Private equity partners approaching 2025 must strategically position themselves to capitalize on explosive growth within the tech sector. By balancing regulatory compliance, leveraging AI both internally and externally, and adopting robust evaluation frameworks, they can mitigate risks while maximizing returns.

The question isn’t just whether your firm is prepared to adapt—but whether it’s ready to capitalize on the immense opportunities these shifts present.

2025 is set to separate the leaders from the laggards. By embracing innovation, prioritizing resilience, and sharpening due diligence, firms can not only survive but thrive in this evolving environment.

Are you interested in future-proofing your investment strategy in the fast-evolving landscape of private equity? Contact our team to explore tailored solutions designed for 2025 and beyond.

Article Citations

1. Scale Capital. “Generative AI Landscape Q3 2024 Insights.” https://www.scalecapital.com/stories/generative-ai-landscape-q3-2024-insights#:~:text=The%20global%20venture%20funding%20in,Q3%202023%2C%20according%20to%20Crunchbase.

2. Private Equity International. “Three Key Trends in Tech Investment.” https://www.privateequityinternational.com/three-key-trends-in-tech-investment/.

3. PE Hub. “Tariff Impact on PE Deals: What’s Exposed, What’s Resilient.” https://www.pehub.com/tariff-impact-on-pe-deals-whats-exposed-whats-resilient/.

4. The Verge. “CHIPS Act Funding: How Semiconductor Companies Are Positioned.” https://www.theverge.com/24166234/chips-act-funding-semiconductor-companies.

5. PE Hub. “Blackstone Is Building Tools to Intelligently Augment Investment Processes, Says CTO John Stecher.” https://www.pehub.com/blackstone-is-building-tools-to-intelligently-augment-investment-processes-says-cto-john-stecher/.