An Overview of Enterprise Fintech Compliance Requirements

It’s undeniable that the fintech industry has radically changed the world enterprises occupy, delivering speed and efficiency. But for enterprises, innovation doesn’t exist in a vacuum—regulatory complexity scales alongside it. Larger organizations must contend with thorny legacy systems, cross-border compliance, and evolving regulatory frameworks that demand a more strategic approach.

So, where to start with the complex web of regulatory requirements? In this article, the experts at KMS Technology give you an overview of enterprise fintech compliance regulations, plus strategies for building resilient payment systems.

Before we begin, this guide is a dip in the water when it comes to understanding the complex regulatory environment of fintech and is no substitution for an expert-informed strategy. If you’re on a journey to build and scale a fintech product, get in touch. Our expert team will help you navigate critical regulatory requirements and understand what you need to bring your product to market.

With that out of the way, let’s dive in.

An Overview of Fintech Compliance

You don’t need us to tell you that fintech companies operate within a high-stakes financial ecosystem where security, transparency, and trust are completely non-negotiable. The stakes are through the roof when managing financial transactions and navigating data protection laws. And this is why fintech compliance requirements are so complex and important.

At a basic level, fintech compliance means following the rules set by regulatory authorities to prevent fraud, protect consumers, and stop financial crime. Some regulations apply universally, like anti-money laundering (AML) laws, while others depend on location, business model, and customer base.

The rules are constantly evolving, and failing to meet applicable regulations comes at a significant cost. Even for enterprise businesses with the power of funding and industry weight behind them, risk management and a robust compliance program could be the difference between a successful launch and a regulatory roadblock that stalls growth before it begins.

That’s why working with an expert fintech partner is imperative.

The Core Pillars of Enterprise Fintech Compliance

Instead of seeing regulatory requirements as an obstacle, fintech firms that integrate compliance into their operations gain a competitive edge, building trust, avoiding disruptions, and keeping regulators off their backs.

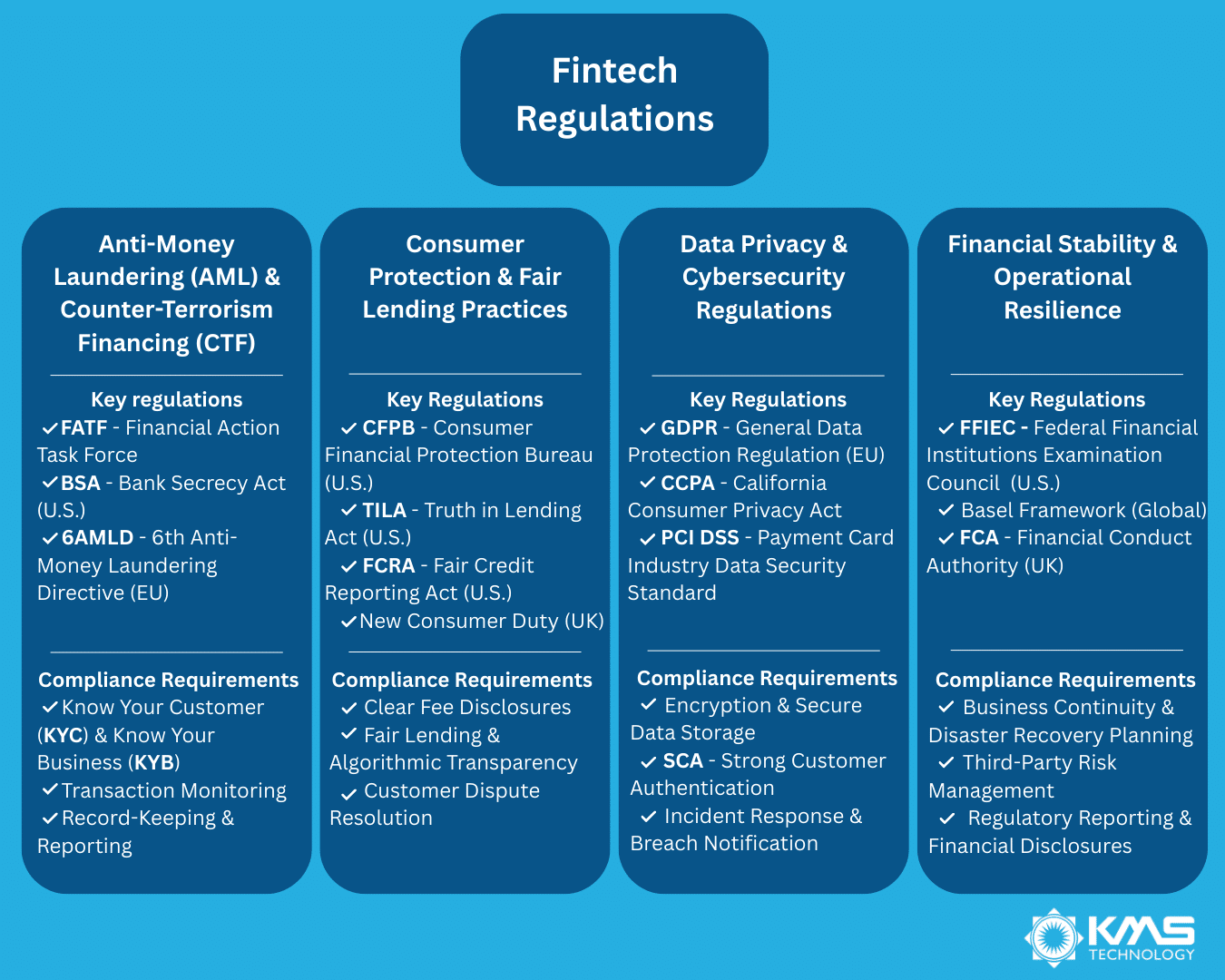

Regulations (and regulatory bodies) vary by country, but certain compliance priorities we’ve listed below apply across the board. These are the core pillars of enterprise fintech compliance, shaping everything from risk management to customer experience… Let’s take a look.

Anti-Money Laundering (AML) & Counter-Terrorism Financing (CTF)

AML regulatory frameworks are at the top of the list of financial regulations.

Financial crime regulations exist for a reason. Without them, fintech could easily become a haven for illicit transactions. That’s why global regulators enforce strict AML and CTF laws, requiring fintech companies to monitor, verify, and report suspicious activity.

Key Regulations:

- Financial Action Task Force (FATF) – Sets global AML/CTF standards

- Bank Secrecy Act (BSA) (U.S.) – Mandates transaction monitoring and reporting

- 6th Anti-Money Laundering Directive (6AMLD) (EU) – Expands criminal liability for financial crime

Compliance Requirements:

- Know Your Customer (KYC) & Know Your Business (KYB) – Verifying user identities to prevent fraud

- Ongoing Transaction Monitoring – Detecting and flagging suspicious patterns

- Record-Keeping & Reporting – Submitting compliance reports to regulators

Failing to comply can result in steep fines and reputational damage. Just ask Binance, which paid a $4.3 billion settlement for AML violations.

Data Privacy & Cybersecurity Regulations

Fintech companies handle sensitive financial data, which makes them a prime target for cybercriminals. A single data breach can trigger lawsuits, regulatory investigations, and loss of customer trust. That’s why strict data privacy and fintech security regulations exist, ensuring fintech firms implement strong protective measures, identifying vulnerabilities in their systems and remedying them before bad actors find them, too.

Key Regulations:

- General Data Protection Regulation (GDPR) (EU) – Governs data privacy and cross-border transfers

- California Consumer Privacy Act (CCPA) (U.S.) – Sets rules for consumer data handling

- Payment Card Industry Data Security Standard (PCI DSS) – Protects payment card transactions

Compliance Requirements:

- Encryption & Secure Data Storage – Protecting financial and personal information

- Strong Customer Authentication (SCA) – Multi-factor authentication for some relevant transactions

- Incident Response & Breach Notification – Reporting security breaches to regulators and customers promptly

With cybercrime on the rise, governments across the globe are making financial crime a key regulatory priority in 2025 and beyond. Fintech companies should monitor emerging risks and changes in reporting requirements to ensure regulatory compliance and (more importantly) to keep their customers safe.

Consumer Protection & Fair Lending Practices

Fintech moves fast, but that can’t mean customer protections take a backseat. Misleading terms, predatory lending, or unfair credit decisions can lead to lawsuits and regulatory scrutiny under state and federal consumer protection laws. So, keeping on top of your products and the relevant expectations is vital.

Key Regulations:

- Consumer Financial Protection Bureau (CFPB) (U.S.) – Enforces fair lending laws

- Truth in Lending Act (TILA) (U.S.) – Requires transparency in credit agreements

- Fair Credit Reporting Act (FCRA) (U.S.) – Regulates credit checks and reporting

- New Consumer Duty (UK) – Sets standards of consumer protection across all financial institutions and services

Compliance Requirements:

- Clear Fee Disclosures – No hidden fees, misleading terms, or bait-and-switch tactics

- Fair Lending & Algorithmic Transparency – Ensuring AI-driven lending models aren’t biased

- Customer Dispute Resolution – Handling complaints through formal processes

Ignoring consumer protection laws can lead to multi-million-dollar penalties, as seen in major enforcement actions against Buy-Now-Pay-Later and payday lending platforms.

Financial Stability & Operational Resilience

Regulators expect fintech companies to be financially stable and operationally sound — especially when handling large transaction volumes or offering lending products. This isn’t just because they care about your business but because operational resilience is a key component of a robust financial system.

Regulators expect fintech firms to maintain financial stability, prevent fraud, and continue operations through economic shocks.

Key Regulations:

- Federal Financial Institutions Examination Council (FFIEC) (U.S.) – Sets risk management standards

- Basel Framework (Global) – Establishes banking resilience guidelines

- Financial Conduct Authority (FCA) (UK) – Regulates fintech stability

Compliance Requirements:

- Business Continuity & Disaster Recovery Planning – Ensuring fintech operations can survive cyberattacks or economic downturns

- Third-Party Risk Management – Vetting vendors and payment processors for compliance

- Regulatory Reporting & Financial Disclosures – Providing transparency on company stability

Fintech firms that neglect operational resilience can face regulatory shutdowns and business-ending disruptions. Who can forget the banking crisis of 2008 — one of the key drivers of regulatory changes to support system resilience?

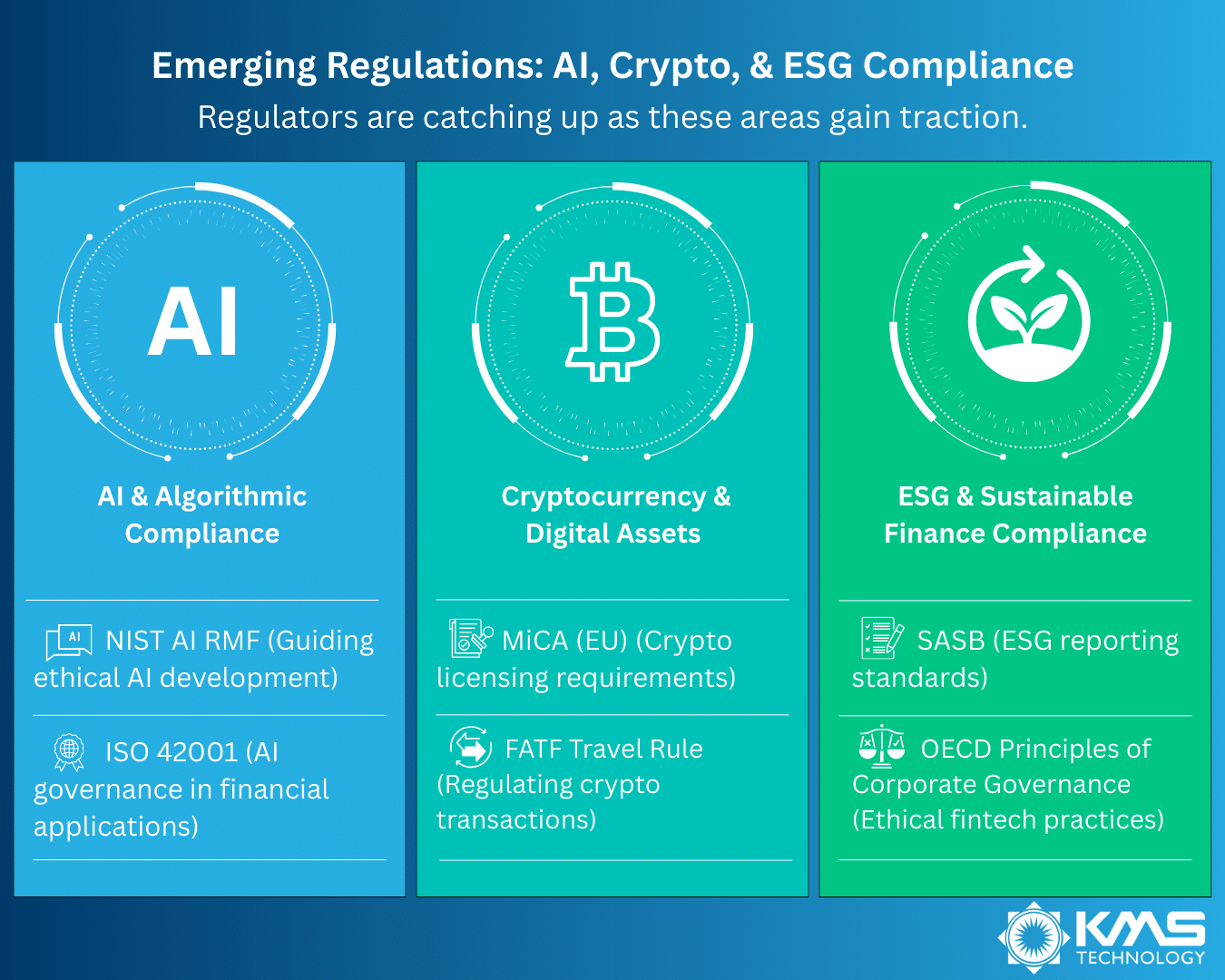

Emerging Regulations: AI, Crypto, & ESG Compliance

Regulators are playing catch-up as AI, cryptocurrency, and ESG (Environmental, Social, and Governance) considerations gain traction.

These areas are rapidly evolving, but fintech regulatory compliance is already becoming a factor.

AI & Algorithmic Compliance:

- NIST AI Risk Management Framework (NIST AI RMF) – Guides ethical AI development

- ISO 42001 – Standardizes AI governance in financial applications

Cryptocurrency & Digital Assets:

- FATF Travel Rule – Regulates crypto transactions to prevent money laundering

- Markets in Crypto-Assets (MiCA) (EU) – Introduces licensing requirements for crypto firms

ESG & Sustainable Finance Compliance:

- OECD Principles of Corporate Governance – Outlines ethical fintech business practices

- Sustainability Accounting Standards Board (SASB) – Defines ESG reporting standards

As these areas gain more oversight, fintech companies must adapt early or risk falling behind.

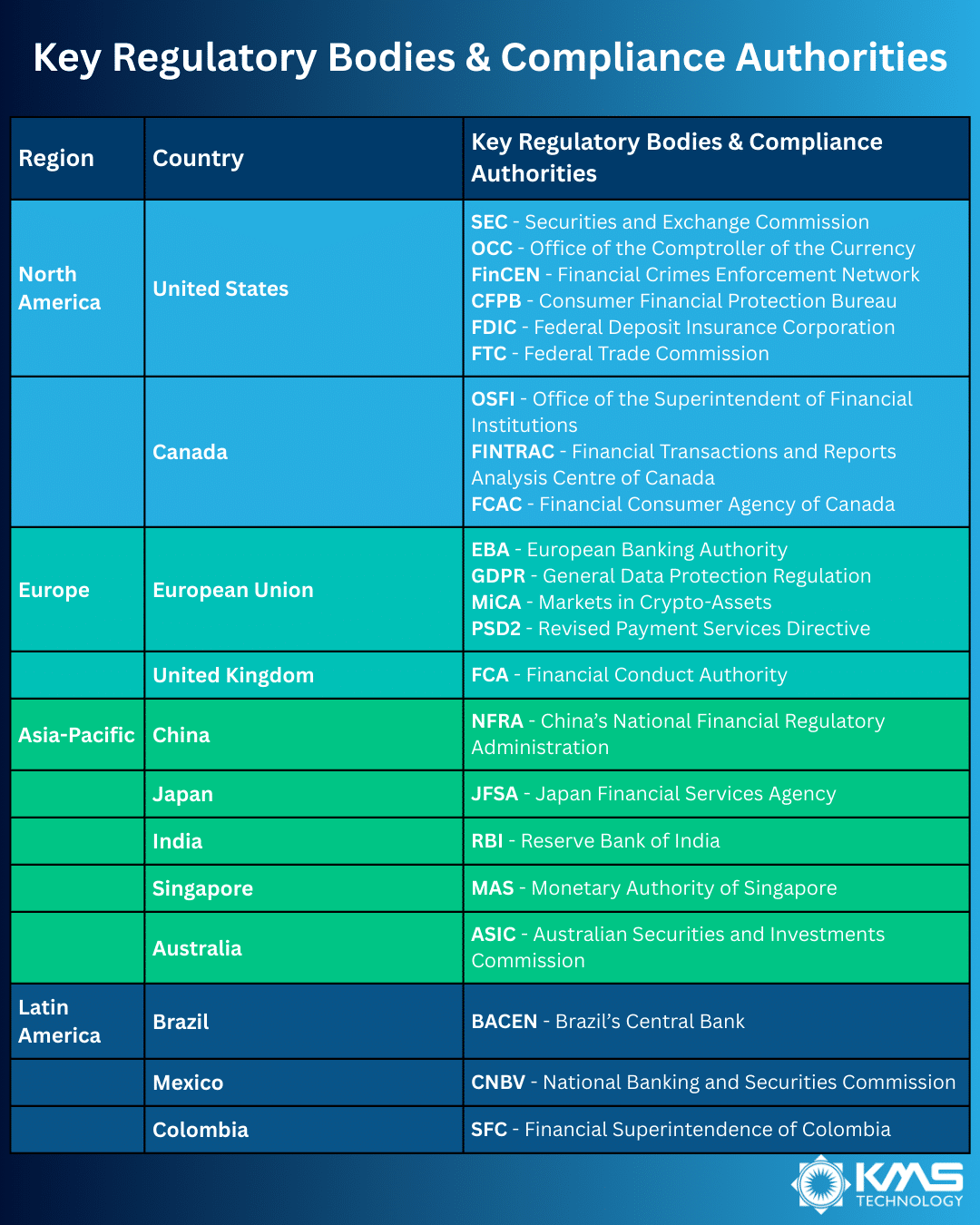

Global Regulatory Landscape: Who Oversees Fintech?

While the key pillars of regulatory standards covered above are applicable in all markets (albeit under different regulations), one of the key challenges facing multi-national enterprises is that regulatory oversight isn’t uniform.

A fintech firm operating in the U.S. faces different requirements than one in Europe, and companies offering cross-border services must navigate complex international regulations to comply with multiple jurisdictions at once. Keeping track of who enforces what is the first step in building compliance policies that don’t leave gaps.

Let’s break down the key regulatory bodies shaping fintech compliance worldwide.

United States

The U.S. fintech regulatory environment is complex and fragmented, with multiple agencies enforcing different compliance aspects. Some fintech firms fall under banking regulations, while others are treated as financial service providers or technology platforms.

Key U.S. Regulators:

- Consumer Financial Protection Bureau (CFPB) – Enforces consumer protection laws, covering fair lending, credit reporting, and disclosure requirements.

- Financial Crimes Enforcement Network (FinCEN) – Oversees AML and counter-terrorism financing (CTF) compliance, requiring fintech firms to monitor transactions and report suspicious activity.

- Securities and Exchange Commission (SEC) – Regulates fintechs dealing in securities, including cryptocurrency exchanges and investment platforms.

- Federal Trade Commission (FTC) – Enforces data privacy and cybersecurity regulations, particularly for fintechs handling consumer financial data.

- Office of the Comptroller of the Currency (OCC) – Supervises national banks and fintechs that apply for special-purpose banking charters.

- Federal Deposit Insurance Corporation (FDIC) – Regulates fintech partnerships with traditional banks, ensuring financial stability.

Fintech companies in the U.S. face a fragmented regulatory landscape, navigating state-by-state variations like California’s strict CCPA data privacy laws compared to Texas’ financial regulations.

European Union & United Kingdom

The EU and UK take a stricter, consumer-first approach to fintech regulation, with clear frameworks for data privacy, payments, and digital assets.

Key Regulators in Europe & UK:

- General Data Protection Regulation (GDPR) (EU) – The world’s strictest data privacy law, governing how fintechs handle consumer data.

- Financial Conduct Authority (FCA) (UK) – Regulates financial services firms, ensuring transparency and financial stability.

- European Banking Authority (EBA) – Develops banking and fintech regulations across the EU.

- Markets in Crypto-Assets (MiCA) (EU) – Introduces a licensing framework for crypto businesses.

- Revised Payment Services Directive (PSD2) (EU) – Governs open banking and strong customer authentication (SCA).

Asia-Pacific (APAC)

The APAC region is home to some of the fastest-growing fintech markets, but regulations vary widely across countries. Singapore and Australia lead in regulatory clarity, while China and India have introduced strict fintech controls.

Key Regulators in APAC:

- Monetary Authority of Singapore (MAS) – A pro-fintech regulator that created a regulatory sandbox for fintech innovation.

- Reserve Bank of India (RBI) – Regulates India’s digital lending, payment gateways, and crypto policies.

- Japan Financial Services Agency (JFSA) – Oversees digital banking, crypto exchanges, and financial stability.

- Australian Securities and Investments Commission (ASIC) – Regulates financial services, including fintech lending and investment platforms.

- China’s National Financial Regulatory Administration (NFRA) – Imposes strict controls on fintech, particularly in payments and digital lending.

Fintech companies in the APAC region face regulatory uncertainty in China, where crackdowns on digital payments and lending create market instability.

Stricter crypto oversight in Japan and Singapore with tighter licensing requirements might make crypto fintech challenging. And expect a mixed approach to innovation in this region, as some markets embrace fintech growth while others impose heavy restrictions.

Canada

Canada’s fintech sector operates under a mix of national and provincial regulations, with an emphasis on consumer protection and anti-money laundering.

Key Canadian Regulators:

- Office of the Superintendent of Financial Institutions (OSFI) – Supervises fintech partnerships with banks.

- Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) – Enforces AML and CTF regulations.

- Financial Consumer Agency of Canada (FCAC) – Oversees consumer protection laws for financial services.

Fintech companies in Canada must navigate regulatory fragmentation, balancing compliance with both national and provincial laws while also addressing stricter consumer data rules under the Personal Information Protection and Electronic Documents Act (PIPEDA).

Latin America (LATAM)

Latin America’s fintech industry is booming, drawing the eyes of many U.S. and EU enterprises… but regulations remain inconsistent across countries. Some governments, like Brazil and Mexico, have fintech-specific laws, while others rely on traditional banking rules.

Key Regulators in LATAM:

- Brazil’s Central Bank (BACEN) – Created open banking regulations to promote fintech innovation.

- National Banking and Securities Commission (CNBV) (Mexico) – Regulates financial institutions, including fintech firms.

- Financial Superintendence of Colombia (SFC) – Oversees digital lending and payments.

Fintech companies in Latin America face a lack of unified regulations, with some countries enforcing fintech laws while others have no clear framework. Evolving regulations cause uncertainty.

The complexity of regulations increases significantly for global organizations. Cross-border payment processors must reckon with these regulations, in addition to conversions, which can be incredibly challenging. Thus, understanding how to operate in a global landscape requires significant domain knowledge and expertise.

Building a Resilient Fintech Compliance Strategy

With so many regulatory requirements clammering for space in your risk assessments, understanding which compliance practices to follow involves partnering with an expert to help your fintech go to market faster.

Here’s how we recommend fintech enterprises approach their compliance strategy.

1. Develop a Compliance-First Culture

A compliance-first culture means that fintech enterprises integrate regulations into every stage of the development process, preventing costly last-minute fixes and making compliance tasks embedded in day-to-day activities.

Embedding compliance into decision-making means:

- Product teams factor in financial regulations when developing new services

- Engineering teams design secure infrastructure that meets data protection laws

- Customer service teams understand dispute resolution and fair lending requirements

- Compliance training is given to every key stakeholder in the business

When compliance is integrated rather than enforced as a separate function, fintech firms reduce risks while maintaining operational agility.

2. Leverage Technology

Manual compliance processes can slow fintech companies down, especially as they scale. Automated solutions help manage risk, detect fraud, and ensure regulatory reporting is accurate.

Key areas where automation improves compliance:

- KYC & Identity Verification – AI-driven tools streamline onboarding while reducing fraud and ensuring compliance in every process

- AML Transaction Monitoring – Automated systems detect and flag suspicious activities, helping reduce crime such as terrorist financing, money laundering, and consumer fraud.

- Regulatory Reporting – Compliance reporting tools reduce manual errors and audit risks

KMS Technology helps fintech firms integrate AI-driven compliance solutions that improve efficiency, strengthen security, and simplify regulatory adherence.

3. Manage Third-Party Compliance Risks

Many fintechs rely on banking-as-a-service providers, cloud storage vendors, or AI-driven risk assessment tools. Regulators expect fintech firms to ensure that these partners also meet compliance standards.

A strong third-party risk management strategy includes vendor due diligence, contractual safeguards, and ongoing audits to ensure financial stability.

4. Continuous Compliance Monitoring

Regulations change frequently, and fintech firms (alongside other financial institutions) must stay ahead of updates rather than react when new laws take effect.

Best practices for continuous compliance include:

- Regulatory Intelligence – Monitoring global regulatory changes in real-time

- Internal Audits & Risk Assessments – Regularly evaluating compliance programs for gaps

- Cross-Team Collaboration – Keeping compliance, legal, and product teams aligned

The Next Steps for Compliance

Regulatory complexity is part of the fintech landscape, but companies that treat compliance as a strategic priority gain a competitive edge. A proactive approach that integrates automation, risk management, and third-party oversight enables fintech firms to scale confidently, taking advantage of fintech trends while meeting regulatory demands.

With the right technology partner, fintech regulatory compliance doesn’t have to be a barrier to growth. Need expert support? Get in touch with KMS Technology to simplify compliance and strengthen your fintech operations.